HV-AC contractor

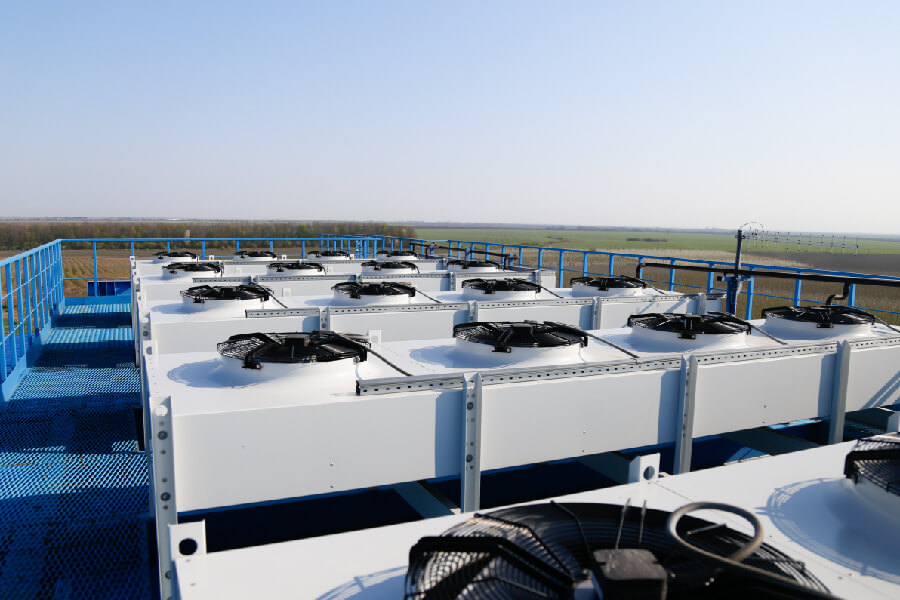

Heating, ventilation and air conditioning

Get My Quote

An HV-AC Contractor Insurance

Finding The Right Insurance For Your HV-AC Business Is An Important Step In Protecting And Growing Your Business. KYC Insurance® handles all your Insurance needs!

What Does an HV-AC Contractor Do?

HV-AC contractors play an important role in installing and maintaining equipment that allows us to have clean, healthy indoor air with comfortable temperatures year-round. A hot air heating, ventilation and air conditioning contractor manufactures, installs, maintains, and repairs hot air heating systems and water heating pumps.

With hot air appliances; complete ventilation systems with blowers and plenum chambers; complete air conditioning systems with air conditioning unit; and the ducts, registers, ducts, humidity and thermostatic controls and air filters in connection with any of these systems.

What Insurance Coverage Do I Need As An HV-AC Contractor?

Making sure your business has the proper insurance coverage is a smart way to qualify for new HV-AC jobs. HV-AC contractor insurance can also keep your business financially protected in the event of an accident or if your business damages property.

Here are some of the most common coverages for HV-AC contractors:

Protect your business if you physically harm another person or cause damage to someone else’s property. Many customers require electrical contractors to be commercial liability insurance in order to be hired.

Property Damage: Accidentally dropping your tool belt and damaging your client’s custom flooring.

Bodily Injury: A customer trips over missing power lines and sues his company for negligence.

Products and Operations Completed: Due to faulty electrical work, one month after completing a job, a fire starts at the customer site. The client sues your company for damage caused by fire.

Provides protection for property that your business owns or is responsible for.

Commercial property insurance provides protection for the property stored in your office owned by your business. If your business owns your office, it can also provide protection for the building itself.

You have computers and inventory in your office. A fire breaks out that destroys the property stored in your office.

Protect your business if you or one of your employees have caused injury or harm to another person while driving a commercial vehicle or while driving for business purposes. It also protects your company vehicles against damage or theft.

Your work truck crashes into another vehicle on the way to electrical work. The other driver is injured and sues your company.

Your company truck is stolen from the parking lot in front of your company.

Protect property before or during installation. For contractors, this could cover building materials or accessories that you are transporting or installing for clients.

You store building materials at a customer’s site. They are stolen at night when no one is present on the site.

It provides funds for medical expenses and lost wages if one of its employees is injured or dies while working. In almost all states, workers’ compensation insurance is required for businesses that have employees.

One of your employees receives an electric shock and injures his hands. Workers’ compensation insurance provides coverage for an employee’s medical bills, rehabilitation expenses, and a portion of his lost income while he is unable to work.

Get your Certificate in 2 HOURS!

With KYC Insurance® your certificate delivery is fast and easy!

NOTICE: Some policies may take longer depending on current status and other special considerations.

Get My Quote

Send us a Whatsapp or Call us!

One of our experts will be with you right away!